Closing Revenue Accounts Journal Entry

Other names used for general journal. This is done using the income summary account.

Closing Revenue Expense And Dividend Accounts Principlesofaccounting Com

We have to record this revenue to increase the retained earnings as the prior years income statement is already closed.

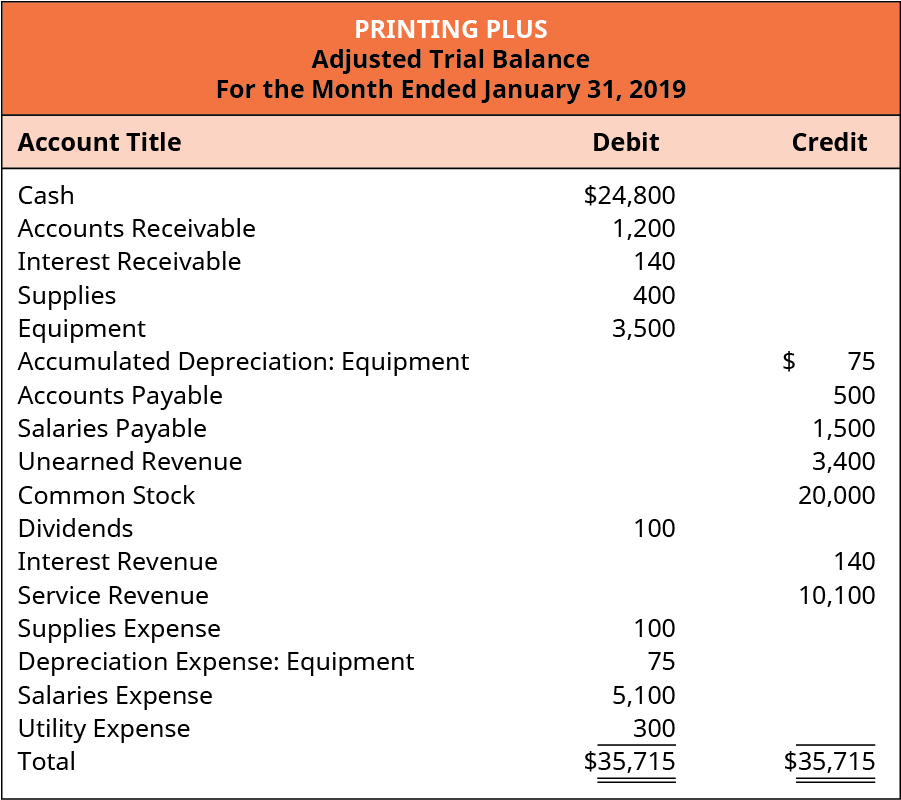

. Likewise the company uses one of the two systems to make journal entry for inventory purchase. Income Summary is a temporary account used during the closing process. Close revenue accounts to Income Summary.

In addition to this Robert Johnson Pvt Ltd made purchases worth 6000000 during the year. There are four closing entries that update the stockholders equity account. Therefore cash accounts will be credited.

Journal entries can be simple ie one debit and one credit or compound ie one or more debits andor more credits. It is commonly used in situations when either revenue or expenses were accrued in the preceding period and the accountant does not want the. The information from the T-accounts is then transferred to make the accounting journal entry.

Journal entry is recorded in the journal ie the primary books of accounts while vouchers are the record documents kept as evidence for the journal entry. A temporary account is an income statement account dividend account or drawings accountIt is temporary because it lasts only for the. To make a journal entry you enter details of a transaction into your companys books.

The Chart of Accounts established by the business helps the business owner determine what is a debit and what is a credit. However there is no such difference in journal vouchers. A Journal entry is the first step of the accounting or book-keeping process.

The purpose of a journal entry is to physically or digitally record every business transaction properly and accurately. That compound journal entry might look like this. The journal entry is debiting accounts receivable of 5000 and credit retained earning 5000.

In the second step of the accounting cycle your journal entries get put into the general ledger. Under the perpetual system the amount of inventory purchase is posted to the inventory account while under the. Typically the general journal entries record transactions such as the following.

An adjusting journal entry is an entry in financial reporting that occurs at the end of a reporting period to record any unrecognized income or expenses for the period. In this step all the accounting transactions are recorded in general journal in a chronological orderThe general journal is maintained essentially on the concept of double entry system of accounting where each transaction affects at least two accounts. The general journal is a book of prime entry and the entries in the journal are not part of the double entry posting.

Adjusting Journal Entry. Journal Entry for Fixed Deposit Fixed deposit Rs. Post closing entries in the general journal.

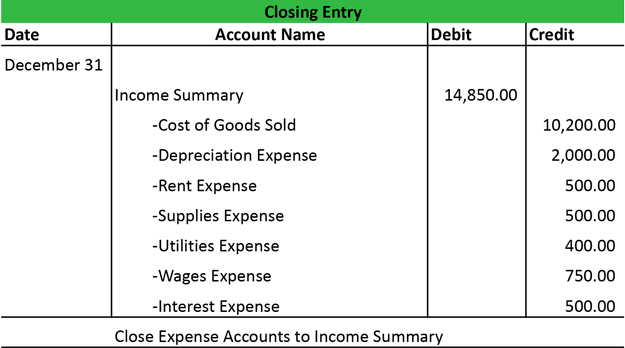

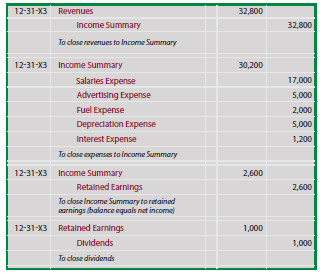

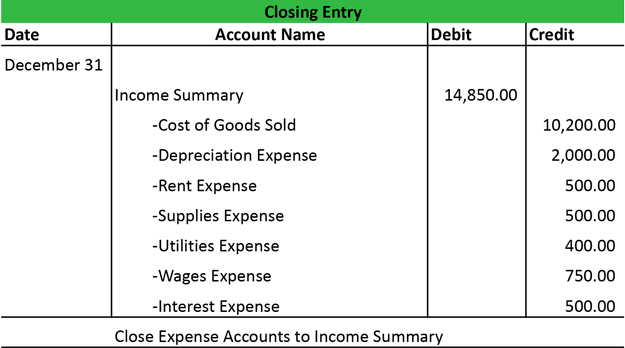

The best way to learn how to record debits and credits is to use T-accounts then turning them into accounting journal entries. Most companies will accrue those payables with a journal entry to be reversed in the. Below are examples of closing entries that zero the temporary accounts in the income statement and transfer the balances to the permanent retained earnings account.

Here we detail about the seven important types of journal entries used in accounting ie i Simple Entry ii Compound Entry iii Opening Entry iv Transfer Entries v Closing Entries vi Adjustment Entries and vii Rectifying Entries. Clear the balance of the revenue account by debiting revenue and crediting. Post deferrals accruals and reversals.

In the journal entry of inventory purchase the difference between the perpetual system and periodic system is on the debit side. 100000- was deposited in SB BANK Fixed Deposit AC Dr 100000 To SB BankAC 100000 Being fixed deposit was done in SB Rules for passing Journal entry Debit Fixed deposits are treated as non-current asset or current asset is depended on maturity period if maturity period is less than one year. Accounting period end closing entries.

By closing nominal accounts at the end of the period to zero it is possible to isolate next periods information correctly. Example of a Closing Entry. For example say our catering purchase incurs both state and local taxes.

Robert Johnson Pvt Ltd needs to determine its accounts payable turnover ratio for 2019 It had an opening accounts payable balance of 500000 and a closing accounts payable balance of 650000. Review and post revenue recognition from schedules. Closing journal entries are used at the end of the accounting cycle to close the temporary accounts for the accounting period and transfer the balances to the retained earnings account.

If a transaction affects multiple accounts the journal entry will detail that information as well. Simple entries are those entries in which only two accounts are affected one account. Temporary and Permanent Accounts.

Allowance for doubtful accounts. After the second closing entry the income summary account is equal to the net income or loss for the period. The reversing entry typically occurs at the beginning of an accounting period.

The profit is also understated it is the same as the retained earnings. Sales Return in terms of payroll journal entry can be defined as the one which shall be used to account for the customer returns in the books of account or to account for when there is a return of goods sold by the customer due to defective goods sold or misfit in requirement of the customer etc. A reversing entry is a journal entry made in an accounting period which reverses selected entries made in the immediately preceding period.

Every journal entry in the general ledger will include the date of the transaction amount affected accounts with account number and description.

1 15 Closing Entries Financial And Managerial Accounting

Closing Entry Definition Online Accounting

Closing Entries Are Journal Entries Made To Close

Closing Entries Types Example My Accounting Course

0 Response to "Closing Revenue Accounts Journal Entry"

Post a Comment